Sales tax calculator 2021

Estimate your state and local sales tax deduction. Your household income location filing status and number of personal exemptions.

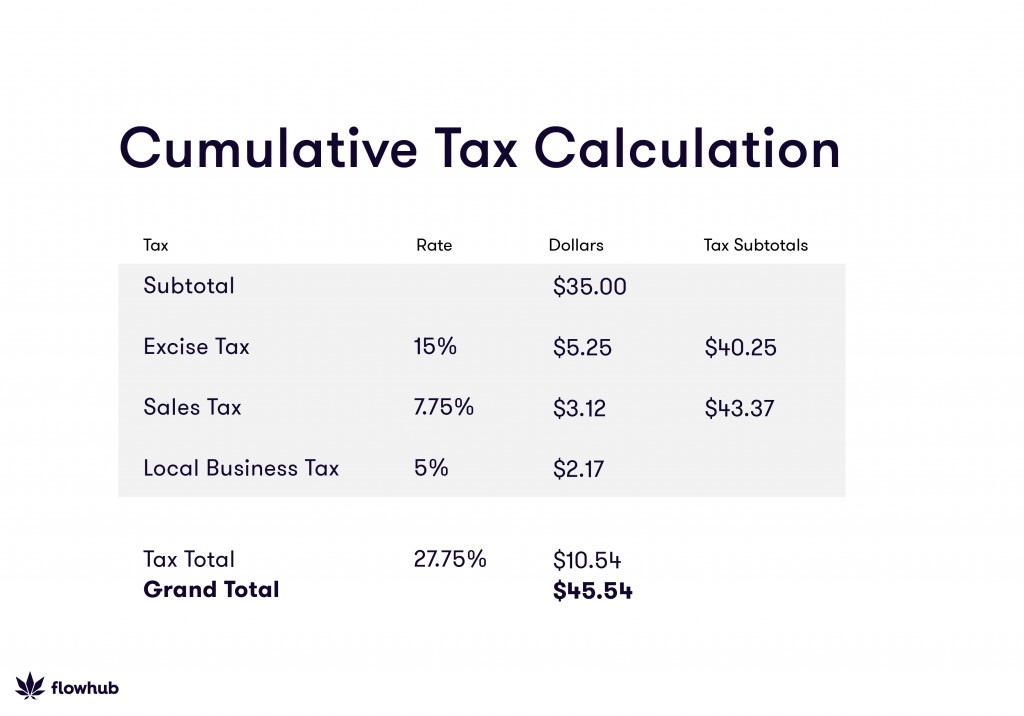

How To Calculate Cannabis Taxes At Your Dispensary

That entry would be 0775 for the percentage.

. Sales Tax Calculator. Usually the vendor collects the sales tax from the consumer as the consumer makes. The second script is the reverse of the first.

The base state sales tax rate in Massachusetts is 625. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. The District of Columbia state sales tax rate is 575 and the average DC sales tax after local.

Formula for calculating the GST and QST. Save time and increase accuracy over manual or disparate tax compliance systems. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

Sales tax is calculated by multiplying the. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. Amount without sales tax.

This is a single district-wide general sales tax rate that applies to tangible personal property and selected services. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sales Tax Deduction Calculator.

How much is sales tax in Massachusetts. Amount without sales tax x QST rate100 QST amount. Maximum Possible Sales Tax.

Maximum Local Sales Tax. Texas State Sales Tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Average Local State Sales Tax. Local tax rates in Massachusetts range from 625 making the sales tax range in. The Washington DC sales tax rate is 6 effective October 1 2013.

Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. This step is about your income and any. Amount before sales tax x GST rate100 GST amount.

New Jersey has a 6625 statewide sales tax rate. If you know the total sales price and the sales tax percentage it will calculate. The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 507 percent Colorado 475 percent New York 452 percent and.

Sales Tax Rate Calculator. 2022 District of Columbia state sales tax. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

The results do not include special local taxessuch as admissions. Exact tax amount may vary for different items. Enter the sales tax percentage.

Maryland has a 6 statewide sales tax rate and. This means that sales tax rates can be very different even in locations that are only a few miles from each other.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

How To Calculate Cannabis Taxes At Your Dispensary

Sales Tax Api Taxjar

How To Calculate Sales Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

How To Calculate Sales Tax

Sales Tax Calculator

Sales Tax Calculator Taxjar

How To Calculate Sales Tax Definition Formula Example

Sales Tax Calculator

Sales Tax Calculator Taxjar

How To Calculate Cannabis Taxes At Your Dispensary